What is the purpose of an LEI number ?

The first LEI (Legal Entity Identifier ) was issued in December 2012. The global LEI system (GLIES) has been set up by regulatory authorities (including G20 and Financial Stability Board) to address the global financial crisis. The LEI is designed to enable the identification and linking of parties to financial transactions in order to manage counterparty risk. Its goal is to help improve the measuring and monitoring of systemic risk and support more cost-effective compliance with regulatory reporting requirements. LEI serve as a proof of identity for a financial entity.

LEIL as an LOU

The parent Company CCIL, offers a host of services that enables trading on sophisticated Trading Platforms, reporting trades to a comprehensive Trade Repository, settle the trades on a guaranteed basis through its CCP services and enjoy a range of post-trade services. At every stage, the LEI will be a useful value-addition. LEIL uses its parent company's expertise in trading, reporting and settlement engines to bring to you LEI web portal that provides a number of benefits:

- Self-registration - Set yourself up quickly and simply

- Advanced search and filter including foreign LEIs - helps you find the information you need quickly

- Challenges - assists with the proactive maintenance of entity data

- Easy to use interface - User Guide, FAQs and very little training required

- Accuracy and reliability - Rigorous duplicate check from consolidated database from other LOUs.

RBI circular on Introduction of LEI for large corporate borrowers

RBI vide its recent circular RBI/2017-18/82 DBR.No.BP.BC.92/21.04.048/2017-18 dated Nov 2, 2017 has instructed all SCBs (excluding RRBs), all India Financial Institutions (Exim Bank, SIDBI, NHB, NABARD), Local Area Banks, Small Finance Banks to implement the LEI system for all borrowers of banks having total fund based and non-fund based exposure of ₹5 crore and above in a phased manner.

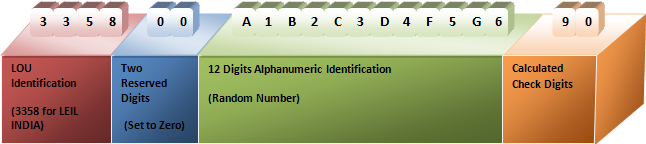

Legal Entity Identifier (LEI)

It has been decided to require banks to make it mandatory for corporate borrowers having aggregate fund-based and non-fund based exposure of ₹ 5 crore and above from any bank to obtain Legal Entity Identifier (LEI) registration and capture the same in the Central Repository of Information on Large Credits (CRILC). This will facilitate assessment of aggregate borrowing by corporate groups, and monitoring of the financial profile of an entity/group. . LEI issued to a Legal Entity remains valid for a period of up to one year from the date of LEI generation or last LEI renewal date.

LEIL has been Accredited by the Global Legal Entity Identifier Foundation (GLEIF) as a Local Operation Unit (LOU) for issuance and management of LEI's

Why is a Legal Entity Identifier required for my organization?

The Legal Entity Identifier (LEI) is a global reference number that uniquely identifies every legal entity or structure that is party to a financial transaction, in any jurisdiction.

LEIL will assign LEIs to any legal identity including but not limited to all intermediary institutions, banks, mutual funds, partnership companies, trusts, holdings, special purpose vehicles, asset management companies and all other institutions being parties to financial transactions.

Read More →