To get all the msme benefits one has to register first and apply for a Udyog Aadhaar...

1. Credit Facilities without Collateral (Schemes discussed below)

2. Capital Subsidies for various manufacturing and service sector units

3. Incentives for various manufacturing and service sector units

4. 1 % Interest Reduction on Overdraft Loans and other loans

5. Startup India Scheme for Innovative Companies - 3 out of 10 Years - No Income Tax to be paid - Allowed as Deduction - Companies upto 10 Years in Existence are still considered Startup - This is Free6. Generator Subsidy7. Concessions on Electricity Bills8. Subsidy on Patent Registration and few Trademarks9. ISO Certification Charges Reimbursement10. MDA Scheme for Registration for Bar Coding11. Special Incentives for Companies Manufacturing COVID-19 Products like - Covid Testing Kits, Sanitizers (Alcohol Based), Ventilators, PPE Kits, 3Ply Surgical Masks, KN95 Masks/ N95 Masks,Hospital Matresses & Pillows, Multipara Monitors,Medical Oxygen12. Allows credit for minimum alternate tax (MAT) to be carried forward for up to 15 years instead of 10 years13. There are many government tenders which are only open to the MSME Industries14. Business registered under MSME are given higher preference for government license and certification.15. Support if you are starting an Incubation Center.16. Incentives for Employment Generation

Apply if you are facing issue with Non Payment on MSME SAMADHAAN Portal - Govt will help in recovering the amount outstanding - Lot of them have got their long pending money back

1. Prime Minister’s Employment Generation Programme (PMEGP)2. Credit Linked Capital Subsidy Scheme for Technology Upgradation (CLCSS) INFRASTRUCTURE SUPPORT TO MSME'S

1. Scheme of Fund for Regeneration of Traditional Industries (SFURTI)2. MSE Cluster Development Programme (MSE-CDP) TECHNOLOGY UPGRADATION AND COMPETITIVENESS SCHEME FOR MSMSE'S

1. Design Clinic Scheme2. Lean Manufacturing Competitiveness Scheme (LMCS)3. Digital MSME Scheme4. Financial Support to MSMEs in ZED Certification Scheme5. Support for Entrepreneurial and Managerial Development of MSMEs through Incubators6. Tool Rooms & MSME Technology Centres *FREQUENTLY ASKED QUESTIONS*

Q. Is MSME updated to Udyog Aadhar?A. Yes, MSME registration has been replaced with the Udyog Aadhar registration. If any micro, small and medium industries want to start any business; they need to do the registration with MSME/Udyog Aadhar

Q. *Is Aadhaar card compulsory*?A. Yes. For registration under the Udyog Aadhar scheme, aadhar card is compulsory for a Sole Prop. In case an applicant is other than the proprietor, the Aadhar card of the partner and the director will be required.

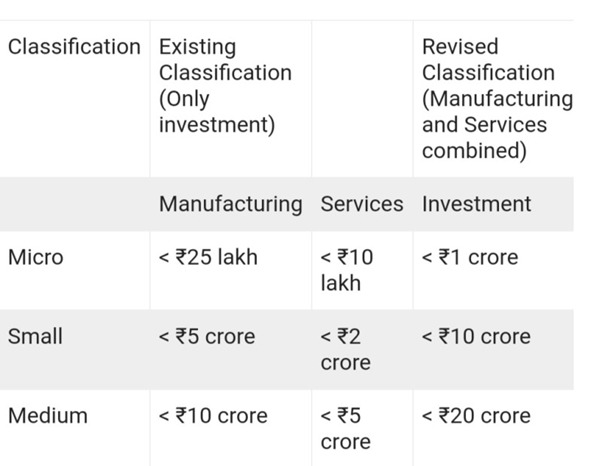

Q. *Can existing and new businesses both apply?*A. Yes, an existing and new business can apply for MSME/Udyog Aadhar registration. Provided the existing unit is functioning and meets the threshold limits for registration under MSME - Creteria for an MSME has been revised now - Check

Q. *What is the validity of the certificate?*A. There is no expiry of the Udyog Aadhar Certificate. As long as the entity is ethical and financially healthy there will be no expiry of the certificate.

Q. *Can Trading companies (Who just buy and Sell) can register under MSME?*A. No. MSME covers only manufacturing and service industries. Trading companies are not covered by the scheme. MSME is to support startups with subsidies and benefits, trading companies are just like middlemen, a link between manufacturer and customer. Hence not covered under the scheme.

Q. *Do I need multiple registrations for manufacturing plants in different cities?*A. No. The MSME/Udyog Aadhar certificate is for a single entity irrespective of multiple branches or plants. However, information about multiple branches or plants must be furnished.

Q. *What are the activities specifically excluded from coverage under MSME?*A. Ministry of Micro, Small and Medium Enterprises (MSME) has clarified as per notification S.O 2576 (E) dated 18.09.2015 and subsequent notification no S.O 85(E) dated 10.1.2017, activities that would be specifically not included in the manufacturing or production of commodities or rendering of services as per Section 7 of the said Act.1. Forest and Logging2. Fishing and aquaculture3. Wholesale, retail trade and repair of motor vehicle and motorcycles4. Wholesale trade except for motor vehicles and motorcycles.5. Retail Trade Except of Motor Vehicles and motor cycles6. Activities of households as employees for domestic personnel7. Undifferentiated goods and services producing activities of private households for own8. Activities of extraterritorial organisations and bodies *The MSME sector contributes to 45% of India’s Total Industrial Employment, 50% of India’s Total Exports and 95% of all industrial units of the country and more than 6000 types of products are manufactured in these industries source:- (As per msme.gov.in)*